MARKET DEMAND

CUSTOMER

VALUES

SUPPLY OFFERING

VALUE PROPOSITION

POSSIBILITY

POTENTIAL

OPPORTUNITY

PURCHASE

CONVERSION

PROMOTION

DEVELOPMENT

ANALYSIS

SECTOR

PRIORITIES

TRADE

AGREEMENTS

FINANCING &

INCENTIVES

TRADE AGREEMENTS

ECONOMIC POLICY

MRI

SCAN

BEST

MARKETS

FSI

MATRIX

EXPORTABLE OFFER

MARKET ACCESS

MARKET

MODE

BUSINESS PRACTICES

MATCH

MAKING

1. BEST MARKETS

MARKET DEMAND

BEST

MARKETS

SUPPLY OFFERING

The BEST MARKET SELECTION tool -BMS- is probably the best available tool for policy makers

to decide in which markets to invest. BMS uses a set of proven criteria and variables to define

in which markets there are POSSIBILITIES for export. Variables used are

1. Actual exports of the sector

2. Macroeconomic variables

a. Economical Classification -World Bank new country classification

b. Country Classification - Coface methodology

3. Growth of imports

a. Imports worldwide

b. Imports from the region

c. Imports from the country

4. Analysis of the competition

a. Participation of the exporting country vs competing countries

b. Market access - trade agreements, preferences, duties

These variables are the basis for performance indicators of the importing and

exporting country alike. Composed indicators yield a number of "best markets"

NATIONAL

TRADE POLICY

ARTICULATION

OF AMBITIONS

SECTORIAL

TRADE STRATEGIES

Onno Roukens of Globally Cool, member of the consortium that developed the BMS tool as part of ProColombia's new methodology:

"We are proud that ProColombia won ITC's TPO award with our program and that we could contribute to making it one of the best TPO's in the world"

CUSTOMER

VALUES

MRI

SCAN

VALUE PROPOSITION

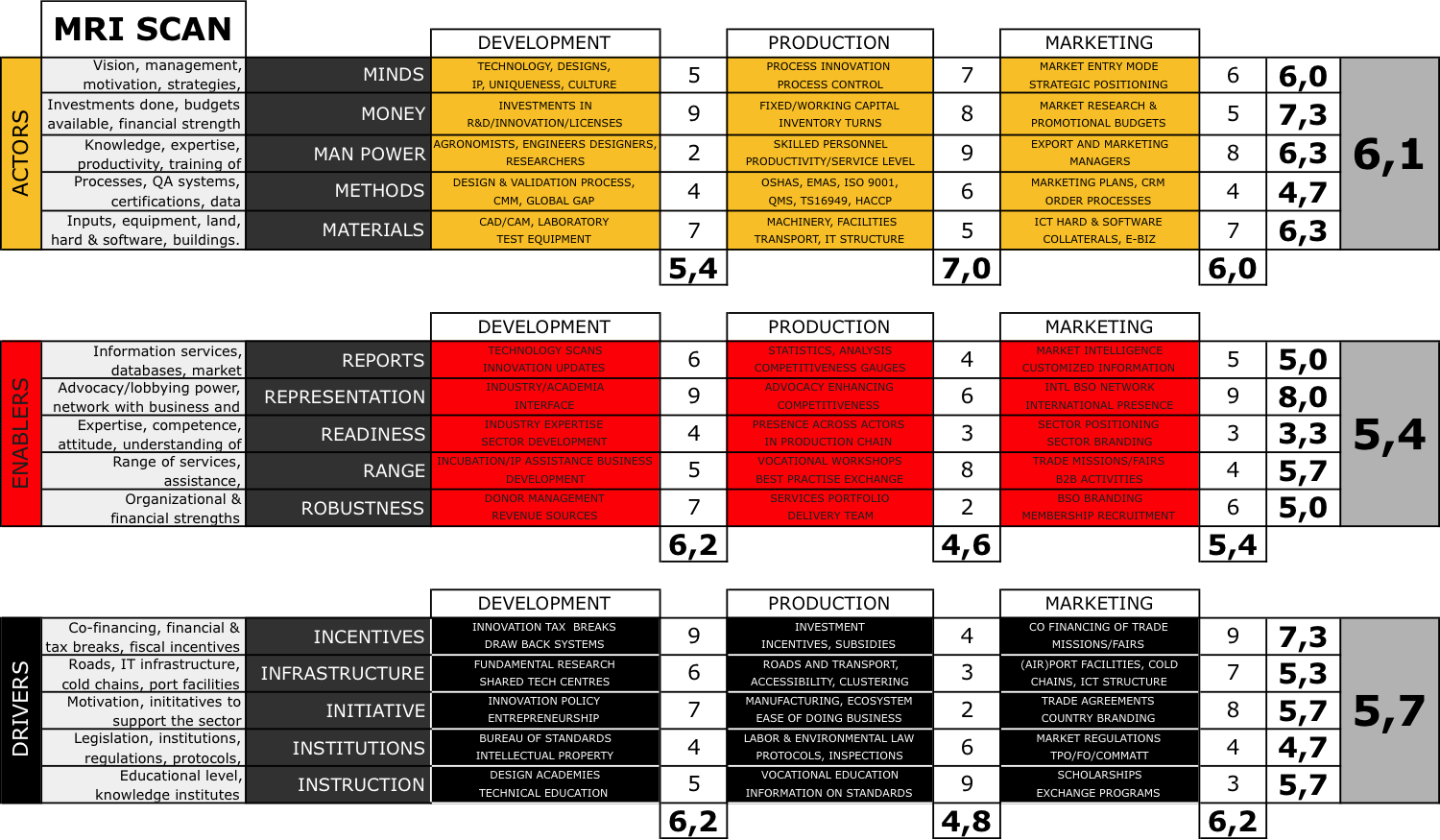

2. MRI SCAN

MARKET DEMAND

BEST

MARKETS

SUPPLY OFFERING

Our unique value chain analysis consists of three steps:

1. Value system identification -stakeholders relevant for the value proposition:

a. ACTORS - companies that are part of the supply chain

b. ENABLERS - support organizations, functional, sectorial and/or regional

c. DRIVERS - government, ministries and other public institutions

2. Stakeholder mapping - relevance and position (bubble graph) in the three value

creating domains:

a. R&D

b. PRODUCTION

c. MARKETING

3. MRI Scan - the confrontation matrix that shows the competitiveness of a sector in

global markets, based on the performances of the three stakeholder groups.

Each of these groups are assessed on a number of criteria, relevant for the

competitiveness of the sector. The outcome is captured in the following formula:

where

C = competitiveness

x = score of actors

y = score of enablers

z = score of drivers

C = x3y2z1

TRADE

ACTOR DIVERSIFICATION

PRODUCT DIVERSIFICATION

MARKET DIVERSIFICATION

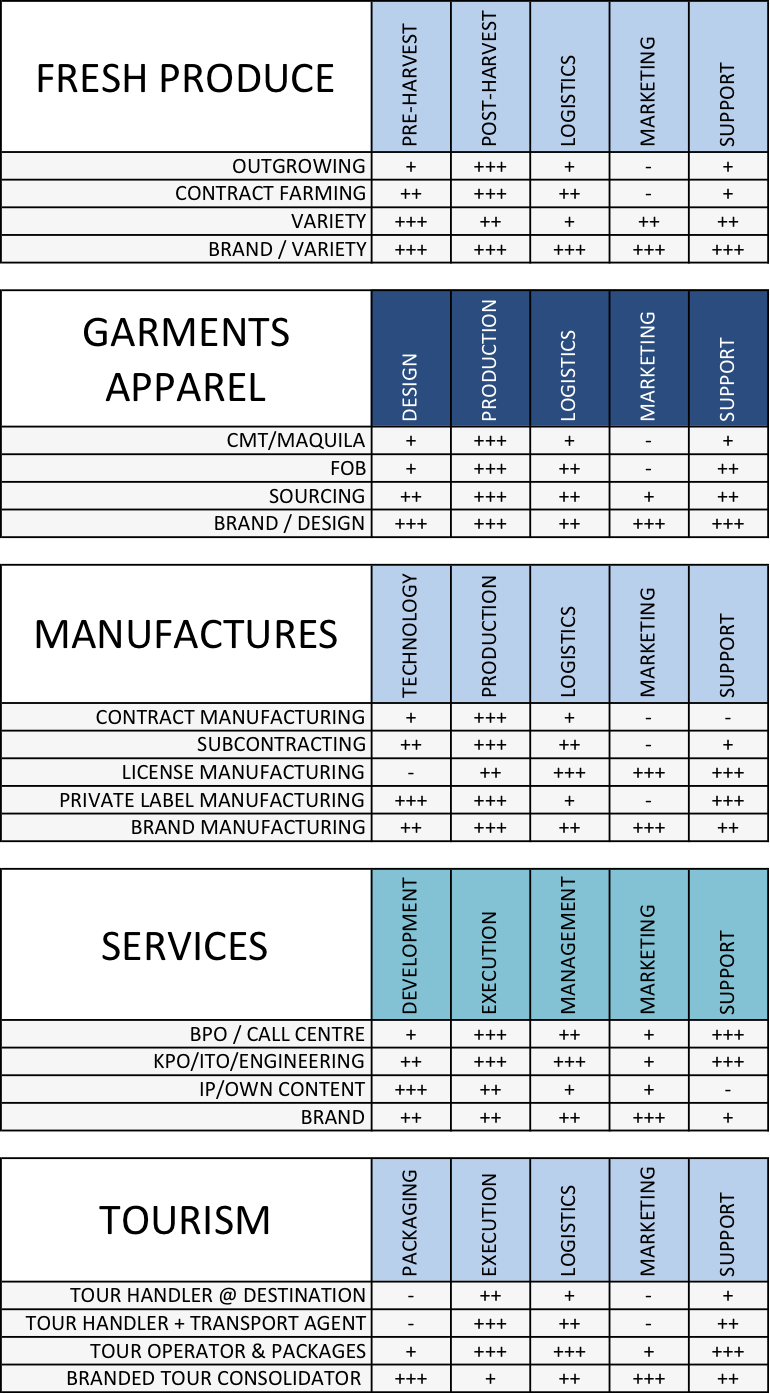

3. FSI MATRIX

ValueNomics

CUSTOMER

VALUES

MRI

SCAN

VALUE PROPOSITION

MARKET DEMAND

BEST

MARKETS

SUPPLY OFFERING

MARKET ACCESS

FSI

MATRIX

EXPORTABLE OFFER

The FSI matrix is a solution design tool for the constraints identified in the MRI scan. It puts :"first things first" to avoid that stakeholders start up uncoordinated actions that are counterproductive to competitiveness enhancement. Like the MRI scan, the FSI matrix is constructed during a strategic conference -as a self assessment, thius increasing the ownership of stakeholders for the outcome.

In the FSI matrix, the constraints are classified according to three criteria:

1. Feasibility - how easy will it be to lift a certain constraint

2. Speed - how likely is it that it can be done in a reasonable timespan

3. Impact - how important is this solution for generation of foreign currency

For each criterion, individual scores are given. The consolidated score is the basis for the sectorial trade strategy and its corresponding action plan

4. MARKET MODE

CUSTOMER

VALUES

MRI

SCAN

VALUE PROPOSITION

MARKET DEMAND

BEST

MARKETS

SUPPLY OFFERING

MARKET ACCESS

FSI

MATRIX

EXPORTABLE OFFER

MARKET

MODE

BUSINESS PRACTICES

MATCH

MAKING

The final step of the trade process is the choice of market mode. This choice is based on the low and high scores of the MRI scan, which are projected on each of the options in the market mode

THE PROCESS

MARKET DEMAND

CUSTOMER

VALUES

SUPPLY OFFERING

VALUE PROPOSITION

POSSIBILITY

POTENTIAL

OPPORTUNITY

PURCHASE

CONVERSION

PROMOTION

DEVELOPMENT

ANALYSIS

MRI

SCAN

BEST

MARKETS

FSI

MATRIX

EXPORTABLE OFFER

MARKET ACCESS

MARKET

MODE

BUSINESS PRACTICES

MATCH

MAKING

TRADE

1. BEST MARKETS

The best markets selection tool reveals the best POSSIBILITIES, theoretical

chances for trade on the basis of quantitative criteria.

2. MRI SCAN

The MRI scan, followed by trade development activities, create the POTENTIAL

for trade, a theoretical chance for trade on the basis of qualitative criteria

3. FSI MATRIX

The FSI matrix shows how to create an OPPORTUNITY, a situation where the

value proposition meets the customer values of target markets

4. MARKET MODE

The market mode converts the opportunities into business

Trade strategies that work

POSSIBILITY

POTENTIAL

OPPORTUNITY

CONVERSION